Module 3 – 32 Managing risk including your money management rules.

Managing risk including your money management rules

One of the essential parts of Forex trading is risk and money management. If a trader is unable to manage his or her money while handling the risks in trading, the entire journey will be questioning. Therefore, we’ll make sure to explain these sections in this course. You shouldn’t confuse money management and risk management. Nevertheless, you can’t win the market without taming both the management concepts. Let’s begin.

Risk management in Forex trading

Instead of learning both the management concepts, let’s have a look at each concept. By doing so, you will be able to understand the concepts clearly.

By following effective risk management techniques, the trader will be able to control losses to a great extent. If you are using proper risk management techniques, exchange rate fluctuations will not impact your trading decisions broadly.

Despite the level of experience in trading, the trader should have a sound risk management plan so that stressful situations in trading can be taken under control. Let’s get started with understanding the entire concept of risk management.

Definition of risk management

The downsides of Forex trading actions can be handled smoothly by following an adequate risk management plan. If the risk is high, you are going to get higher returns, but at the same time, you are exposed to higher risks as well. Hence, a trader must learn the ways to handle risks so that he or she reduce losses while increasing the returns. Every Forex trader should master this skill.

How to handle risks? Well, to manage risk, a trader must focus on position size, trading emotions, exiting positions, entering positions, and stop losses. By implementing these, a trader can secure profitable trades while overcoming losing trades. Now that you know what risk management is, let’s learn the fundamentals of risk management.

Fundamentals of risk management

There are five fundamentals that you should be aware of, so let’s learn them below:

1. Reducing the desire for risk

The integral part of risk management is reducing your desire for risks. Every trader should think about the risks willing to lose on a trade. This should be taken into consideration when trading volatile currencies. Liquidity is one of the factors that impact the risk management in Forex as less liquid currencies are hard to enter and exit as for your preferred price.

If you aren’t confident with the amount you are losing, you will lose high. It may lead to worse scenarios. Even though there are chances for profits and losses, you need to be ready to face risks as it is the best way to wake up to face challenges in trading.

The rule of thumb, followed by many traders, is a 2% risk, but you should do what makes you comfortable.

2. Accurate position size

It is essential to select the precise position size or the number of lots for a trade as it will help you maximize profits while protecting your account. To decide the accurate position size, you should focus on risk percentage, stop placement, lot size, and pip cost.

3. Focus on stop losses

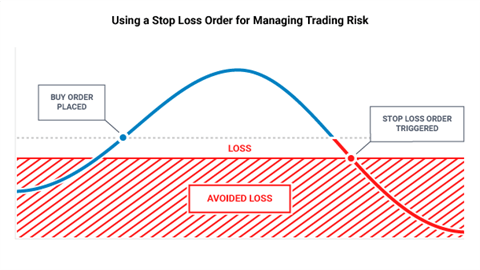

Stop-loss order is another fundamental to risk management. This is placed to close a trade when the trade reaches a specific price. If you are aware of the stop loss point, you will be able to pull yourself away from significant losses. Check the below picture to understand better.

4. Using Leverage

In Forex trading, leverage is very much crucial as it allows the trader to gain more returns that his or her trading account will not allow. However, it is equally dangerous if you can’t manage losses when leveraging.

5. Managing emotions

Something that every beginner struggles with is emotions. As you are risking your hard-earned money, you should learn to control how your emotions when trading. Greed, excitement, stress, and fear are not going to help when you try to manage risks like a pro. To remove negative emotions, you need to maintain a journal that includes trading details so that you know how to focus and trade with strategies.

These are the main factors that you need to consider if you want to handle risk management in trading. Now that we covered risk management, let’s move to the money management concept.

Money management in Forex trading

Even if you understand risk management, it will be useless if you don’t know money management. Therefore, let’s learn about money management now. To succeed in Forex management, you need to have patience, education, and much more. You should look at money management as if it’s a crucial concept, and it should fit into the puzzle to complete the entire puzzle.

Before you begin trading, you should understand the reason why it is essential to use demo trading. Of course, money management will help you handle money accordingly, but learned techniques and strategies should be practiced on a demo account. Then, you will not lose your hard-earned money if things go wrong. Now, let’s focus on a few money management rules.

Money management rules

Now you are aware that money management is a crucial concept in Forex trading, so let’s the rules that you need to follow.

1. The 2% Rule

This is the apparent money management rule that every trader must follow. This rule suggests traders risk only 2% of the money so that the risk is limited. However, even when you are risking 2%, you should be comfortable doing it.

2. Risk/Reward

You shouldn’t overlook the risk-reward ratio when you are risking your money in trading. This rule indicates that your risk should help you make more profit than the amount you risked. If you use this ratio, you will be able to cover up losses without letting it hurt your feelings.

3. Over leveraging

If you don’t use leverage accordingly, you will end up losing your trading account. Hence, you should be wise enough to avoid over-leveraging.

4. Set realistic goals

In trading, you shouldn’t set goals that are impossible to achieve. If you set unrealistic goals, your money management concept will be ruined. Hence, make sure to set goals that can be achieved over time. This is why it is crucial to follow the money management concept.