Module 3 – 31 Trading using trendlines.

Trading using trendlines

We have understood the details and methods related to applying trendlines. Hence, let’s focus on learning ways to trade using trendlines. It is evident that a trendline is a versatile tool for Forex trading. However, you don’t have to confine only to it. Instead, you can use trendlines for position and swing trading as well.

Unfortunately, not every trader gets the concept of trendlines. Hence, things go wrong when they try to utilize it in trading. Now, let’s learn about it in-depth.

The way trendline works

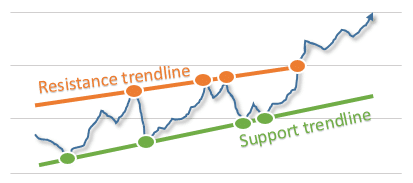

If you don’t know how trendline works, you will not be able to use it when trading. However, we have discussed it in the previous chapters. Hence, we’ll have a glance at what it is. The support and resistance in the area, which is horizontal on your chart, emphasize the buying and selling pressure. Just like for trendline, except for the sloping area.

Once you understand the support and resistant trendline, you can trade Forex using them. But to do so, you have to be careful.

That said, there are some essential points that a beginner needs to know, so here we go:

Versatile trendlines help the traders focus on the direction along with the price speed. As for direction, when a bullish trendline occurs, the price goes up while when a bearish trendline occurs, the price goes down.

However, to find the price speed, you should consider the trendline slope. If the trendline is steeper, it indicates that the speed of the price is falling or rising. You must bear in mind that steeper trendlines will not remain long because the speed of the price cannot prevail for a long time.

These trendlines will help you find ranging and trending market situations, so they are flexible. Also, it is possible to identify patterns such as flags and triangles, as well.

If there are clear support and resistance areas, the trader can focus on trading as it will help execute a good trading strategy.

You should also remember that trendlines are not exact price levels; instead, they are zones. If you witness price breaks and price reversals, at times, it doesn’t mean that it is an invalid level.

The below chart will help you understand the explanation.

However, you should know that broken trendlines aren’t reliable when compared to unbroken ones.

These are some of the essential points that you should remember when you are trading using trendlines. Now, let’s see how to trade using trendlines.

Ways to trade using trendlines

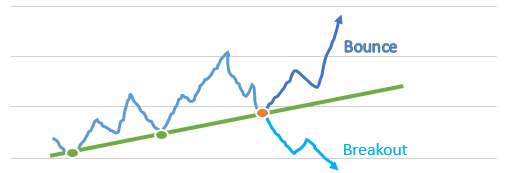

If you select a direction, you will be able to trade successfully using trendlines. Therefore, if you want to trade, pick a direction. You need to think about your move when the price reaches a particular trendline. There are three options, such as:

- The price will hit the line

- The price will bounce back

- The price will break through the line

So here’s a picture to make things more transparent.

Different tools help you decide regarding the trades. If you are comfortable with using fundamental analysis, you can use it to analyze fundamental beliefs. Focus on higher time frames by utilizing technical analysis. You can counter-trend or trade the prevailing trend.

However, the decision you make should be suitable for your trading plan. Now, it’s time to focus on the rest of the options:

- Bounce back

- Breakout

Let’s begin with bounce back.

Ways to trade bounce back

If you want to trade bounce back, you must select the minimum distance. The distance should be calculated from the trendline you wish to take part when the price meets the minimum distance of the open trade. There are tools that you can use to alert you once the price reaches the required level.

Some traders wait for confirmation prior to entering the trade. They don’t open the trade until they find a few touches on the trendline.

For example, the trader may consider a trendline only if the price touches the trendline three times before bouncing back. In this case, a trade will be opened only a fourth time. This confirmation technique will not work often, so you have to be careful when you are waiting for confirmation.

Ways to trade breakout

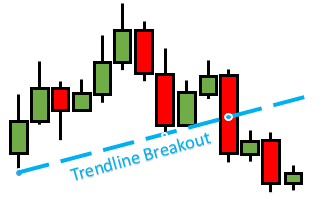

The second type of trading is breakout trading using trendlines. This becomes complicated when you don’t know the meaning; therefore, learn the definition of a breakout before you trade it. The candle that belongs to the time frame you are analyzing must close above the trendline if you want to treat it as a breakout.

The picture below will help you understand things better.

The differences have an impact on trading as the entry points will differ. You might struggle when the close of the candle impacts entry by moving away from the trendline. In contradiction, if you prefer trading when the price crosses a specific trendline, you might have to face price reversals often.

This is the reason why pullback is considered. This means you are not required to enter a trade when the candle closes beyond, or the price breaks the trendline. The simple move you make is to wait until the price returns to the trendlines. Only if this happens, you will consider trading it.

Wrapping up

Summing up, you don’t have to complicate anything if you are using simple techniques trendline trading. However, it is wise to learn everything in detail before making a move in the Forex market.