Module 3 – 30 The Golden Rules of Trendlines.

The golden rules of trendlines

We learned about applying trendlines in the previous chapter. Now, let’s learn the golden rules that you need to be aware of. You already know that you can find support or resistance with the help of trendlines, and they are popular, too. But when you are drawing trendlines, there are a lot of rules that you need to consider. Let’s discuss some of them below.

Definition of trendlines

We thought it is better to begin by explaining trendlines so you can revise the things that you learned in the previous chapter. These lines are used in technical analysis and treated as levels. These levels are drawn along a determined trend to show resistance or support as per the trend direction. It is more like the diagonal equivalent of horizontal resistance and support.

Using trendlines, you can find potential areas where there are demand and supply, which will lead the market up or down.

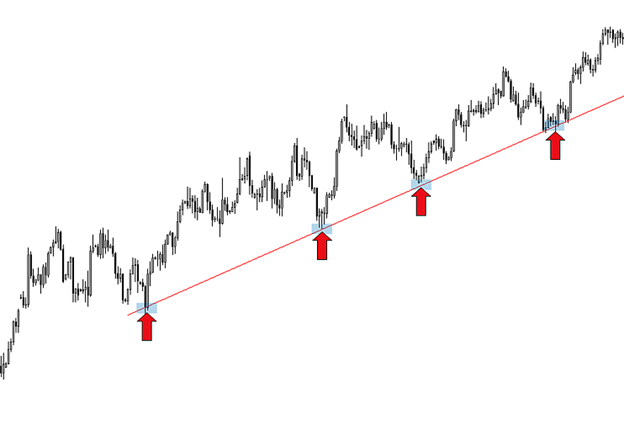

The picture below shows a trendline drawing in an uptrend.

This is a GBPUSD daily chart, and the Forex market has brushed off trendline support a few times for an extended period. The trend line mentioned is the support area where the traders can find purchasing opportunities.

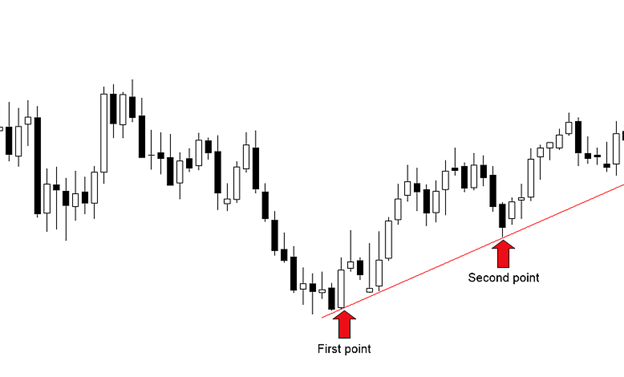

Now, check the picture below shows a trendline drawing in a downtrend.

Just like the GBPUSD uptrend chart, this chart’s downtrend touches off the trendline a few times for an extended period. The difference between the uptrend chart and downtrend chart is that during a downtrend, the trend line acts as resistance. Hence, traders get the chance to find selling opportunities.

Ways to draw trendlines perfectly

You now know what trendlines are, and then, it is time for you to learn the rules to draw them. The very first rule is to have a minimum of two points to start a trend line. Once you have found the second swing low or high, you can begin drawing the line.

The below example shows the identified first two swing lows.

If you check the chart above, you can find two points that are required to draw the trend line. Once you have found this level, you can check for bullish price action. Therefore, you need to understand that to draw the trend line, and you need to spot the two main points. That said, there are some other rules that you must know as a Forex trader, so continue reading.

Key factors to follow when drawing Trendlines

You know the important rule of drawing trendline, but there are some other points that you need to be aware of. These key factors are essential to be followed when drawing trendlines.

- Remember, higher time frames offer reliable trendlines; therefore, begin from there and continue your way down.

- Most trendlines will have overlap from low or high of a candle. However, the crucial point is obtaining most touches without letting the candle’s body cut through.

- Don’t ever force a trendline to fit as you wish because it doesn’t work that way. If it doesn’t fit the chart, it will not so don’t spend your time forcing it on your chart.

- You should be mindful of the third touch point when drawing the trendline as it confirms the slop validity. Hence, look for the third point before going ahead with the main two points.

- It is essential to assess the break. To check whether the price is breaking, you need to be mindful of the timeframe. It is better to watch the daily close of a given trendline closely.

These key factors are crucial to be followed when you are drawing trendlines.

Wrapping up

Once you focus on the rules and important factors related to trendlines, you will be able to understand things clearly. Therefore, you shouldn’t overlook these golden rules. Only by bearing these golden rules in mind, you can trade using trendlines, successfully!