Module 3 – 27 Trading using Gann Swing Theory.

Trading using Gann Swing Theory

You have already learned about Gann Swing Charts, in which we explained a little bit about the theory. But in this section of the course, we are going to dig in little deeper to understand the Gann Swing Theory.

You know that Gann Theory is one of the popular tools that focus on repeatable price action and patterns in a given time. Most traders believe that Gann Theory is an excellent tool to use in trading, but only a few take a step ahead and learn it. If you want to learn the theory, you shouldn’t stick to the biography or history W.D. Gann because it is not meaningful. You will not get practical knowledge by doing those. Instead of focusing on history, think of practical applications. Let’s get started.

Three trends for any time frame

When you are planning to use Gann Swing Theory in trading, you should learn the three trends that can be applied concerning any time frame. The time frames can be minor, major, or intermediate. However, you will be able to apply these three trends. This automatically indicates that there are three swing highs and lows as well for the trends, which will be corresponding to the trends. Now, let’s check the definition for swing tops (highs) and swing bottoms (lows).

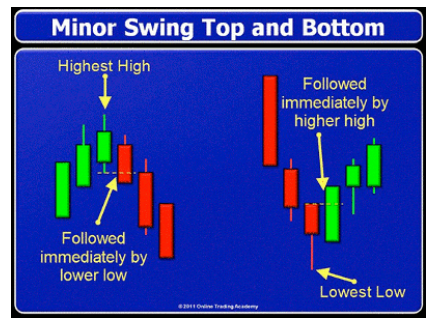

Gann Minor Swings

The low price is compared to previous lows to identify minor bottoms. This is followed right away by the next candle or bar by a higher high and a higher low.

The higher high is compared to the previous high at a price to identify the minor top. This is followed right away by a lower low and a lower high.

See the picture below for better understanding:

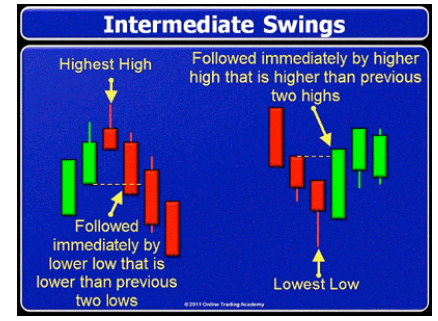

Gann Intermediate Swings

The lower low is compared to previous lows to identify intermediate bottom. Anyway, the last two candles or bars must be higher to ensure intermediate high.

A higher-high than the previous high, which is right away, followed by a low is intermediate top. But a low which is being followed should be lower than the two previous lows.

See the picture below for better understanding:

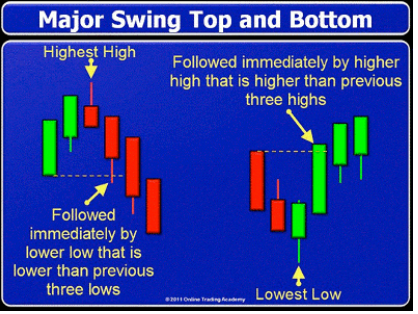

Gann Major Swings

This is an essential section for a trader who uses Gann Theory for analyzing their trades. What does a major bottom mean? It is a low price on a candle or bar, which is lower than previous lows, yet is right away, followed by a high. A high which is being followed must be high than three previous candle highs or bars.

A higher-high, which is higher than previous price action, is the major top. The price action should be right away, followed by a low, which is lower than the previous three candles or bars.

See the picture below for better understanding:

That said, now let’s move to the next section to understand trend identification.

Trend Identification

When you witness the previous swing top with a price breaking situation, then, you should know that the time frame is facing an uptrend. Trading will continue in the long direction until the previous swing bottom exists in the same degree.

However, when using Gann trend analysis, you should know that downtrend happens when swing bottom is broken by price. In an uptrend, if it moves downward and swing bottom isn’t broken, then the trader doesn’t have to exit their long. If swing bottom breaks, it will form an exit signal.

The same rule applies to a downtrend. Once you witness a major downtrend for the time frame that you are trading, you can check for minor swing tops or short immediate until they break.

Wrapping up

That sums up how you should trade using Gann Swing Theory. Understanding Gann Swing Theory and applying it in trading will not be tough if you keep practicing. In trading, one of the integral parts is practicing. Even a complex indicator or a strategy that can be mastered if you are good at practicing.

Moreover, you are allowed to use Demo accounts, and then, you don’t have to think about losing your hard-earned money if something goes wrong. Trading has made practice straightforward. Therefore, as traders, you should take full-benefits of the chance given and trade better!